This post contains affiliate links. We may earn a commission if you click on them and make a purchase. It’s at no extra cost to you and helps us run this site. Thanks for your support!

A Strategic Investment Blueprint for the Year Ahead

As the financial tides shift with evolving economic landscapes, 2025 presents a fresh opportunity for investors to position themselves in industries poised for exponential growth. The rise of artificial intelligence, breakthroughs in healthcare, and the relentless expansion of e-commerce create a compelling backdrop for a thoughtfully structured investment portfolio.

With just $1,000, a strategic allocation can offer a balanced blend of aggressive capital appreciation and defensive stability. Leveraging insights from OpenAI’s ChatGPT and expert financial analysis, this portfolio integrates high-growth stocks, dividend aristocrats, and a safety net for diversified returns.

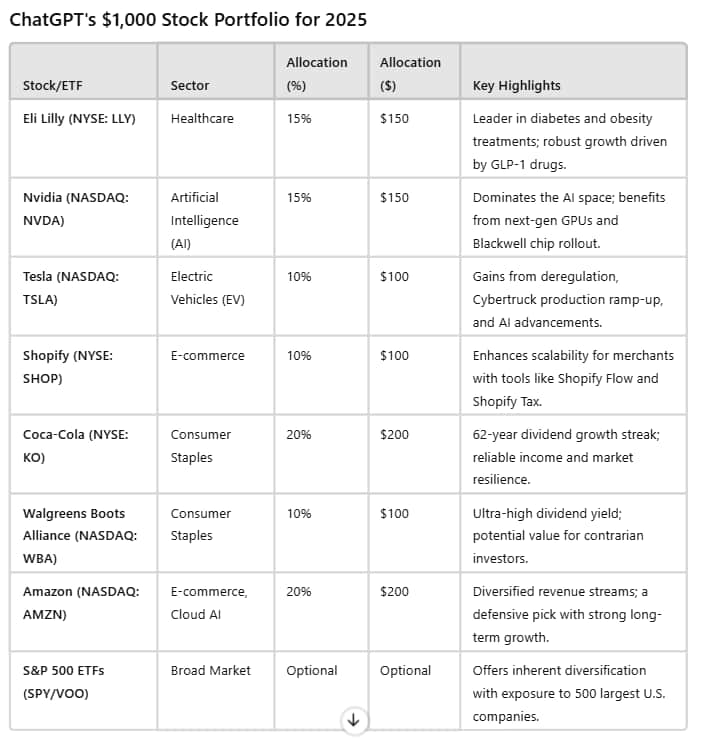

Optimal Stock Allocation for 2025

High-Growth Titans (50% Allocation)

- Eli Lilly (NYSE: LLY) – 15% ($150)

A juggernaut in pharmaceutical innovation, Eli Lilly continues to dominate with its groundbreaking GLP-1 drugs, Mounjaro and Zepbound, fueling massive revenue surges. With a robust pipeline and strong earnings momentum, this stock is a formidable pick for long-term growth. - Nvidia (NASDAQ: NVDA) – 15% ($150)

The kingpin of AI-driven semiconductor technology, Nvidia stands at the forefront of the AI revolution. The launch of its cutting-edge Blackwell chips positions it as the backbone of data centers and AI applications, reinforcing its market dominance. - Tesla (NASDAQ: TSLA) – 10% ($100)

Tesla’s aggressive push in AI, EV expansion, and cost efficiencies make it a compelling high-risk, high-reward play. With the Cybertruck production ramping up and potential regulatory tailwinds, Tesla’s growth trajectory remains intriguing for 2025. - Shopify (NYSE: SHOP) – 10% ($100)

The backbone of modern digital commerce, Shopify’s innovative merchant tools and enterprise integrations ensure its continued dominance in e-commerce. With scalable solutions like Shopify Flow and Shopify Tax, it’s cementing itself as a powerhouse in online retail.

Dividend Stability (30% Allocation)

- Coca-Cola (NYSE: KO) – 20% ($200)

A time-tested dividend giant with an unwavering 62-year growth streak, Coca-Cola remains a staple for defensive investing. Its strong global presence and consistent yield make it an anchor for stability. - Walgreens Boots Alliance (NASDAQ: WBA) – 10% ($100)

Despite restructuring hurdles, Walgreens offers an ultra-high dividend yield, presenting an opportunity for contrarian investors. The company’s strategic realignments could unlock future value while providing a steady income stream.

Defensive & Diversified Picks (20% Allocation)

- Amazon (NASDAQ: AMZN) – 20% ($200)

Amazon’s diversified revenue across e-commerce, cloud computing, and AI fortifies its position as a long-term wealth generator. With AWS leading in cloud infrastructure and AI-driven innovations enhancing its ecosystem, Amazon remains an essential portfolio anchor.

Bonus Diversification Tip:

For investors seeking broader market exposure, allocating a portion of the portfolio to an S&P 500 ETF like SPDR S&P 500 ETF (SPY) or Vanguard S&P 500 ETF (VOO) ensures passive growth tracking the broader economy.

ChatGPT Coupons & Promo Codes with 75% off (30 Working Codes) 2025

Why This Portfolio Works

- Growth-Driven Selections: AI, healthcare, and e-commerce stocks dominate for aggressive upside potential.

- Defensive Strength: Reliable dividend stocks ensure stability in volatile markets.

- Diversified Risk Management: Amazon’s multi-sector presence and S&P 500 ETF options provide a safeguard against sector downturns.

In a dynamic 2025 market, this $1,000 portfolio sets the stage for strategic wealth accumulation, balancing innovation and financial security. Whether you’re a growth-seeking investor or focused on steady returns, this curated selection provides an optimized path to financial success.

KEYWORDS

🔍 Primary Keywords (Top 10)

These are high-impact, core keywords directly related to your topic:

- Best $1,000 stock portfolio 2025

- Top stocks to buy in 2025

- Best investment strategies 2025

- Growth stocks to invest in 2025

- High-dividend stocks 2025

- Best AI stocks for 2025

- Best E-commerce Stocks 2025

- How to invest $1,000 in 2025

- Stock Market Predictions 2025

- S&P 500 Best Stocks 2025

📌 LSI (Latent Semantic Indexing) Keywords (15)

These are semantically related terms that Google associates with your main topic:

- High-growth stocks

- Value investing strategies

- Dividend-paying stocks

- AI-driven stock investments

- Tech stocks to buy

- Market volatility strategies

- Stock diversification tips

- Emerging market stocks

- Defensive stock picks

- Recession-proof investments

- Passive income through stocks

- ETF vs. individual stocks

- Best Performing Sectors 2025

- Stock allocation for beginners

- Investment risks and rewards

📈 Long-Tail Keywords (10)

Highly targeted search phrases that drive specific user intent:

- Best stocks under $1,000 for long-term investment

- How to build a diversified stock portfolio with $1,000

- Best AI and healthcare stocks for 2025

- Top dividend-paying stocks for passive income in 2025

- How to invest $1,000 in stocks as a beginner

- Best-performing ETFs vs individual stocks in 2025

- Safe stock investments for stable returns in 2025

- How to balance growth and dividends in a portfolio

- Best strategies to maximize a $1,000 investment in stocks

- Stock market sectors expected to outperform in 2025

❓ Question-Based Keywords (5)

These represent popular questions users are asking related to the topic:

- What is the best way to invest $1,000 in 2025?

- Which industries are expected to grow the most in 2025?

- Are dividend stocks better than growth stocks for 2025?

- What are the safest stock investments for beginners in 2025?

- How can I diversify a small investment portfolio effectively?

🔥 Potential Blog Titles (SEO-Optimized)

Using the keywords identified, here are 3 compelling and SEO-friendly blog post titles:

“Best Growth & Dividend Stocks for a $1,000 Portfolio in 2025: Maximize Your Profits”

“The Best $1,000 Stock Portfolio for 2025: Growth & Dividend Picks for Maximum Returns”

“How to Invest $1,000 in 2025: Top Stocks, Market Trends, and Smart Strategies”